Insights

Welcome to our Insights Page where we will share the latest news, views, tips, and advice for our client base. If there is anything of particular relevance or importance, then this will be communicated directly on an individual client basis and is all part of the service we provide.

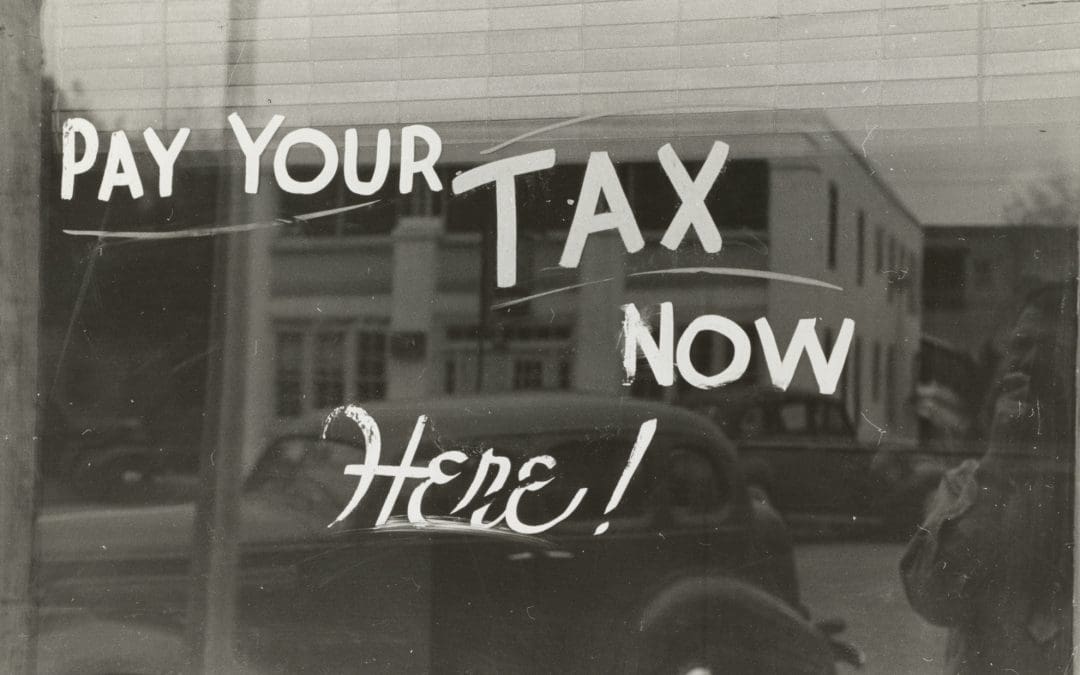

The Tax Return deadline is looming… but don’t worry, there’s still time!

We understand that life gets busy, but it’s not too late to get your tax returns sorted. If you’re unsure whether you need to file or feel overwhelmed by the process, we’re here to help. We’ll make it simple, stress-free, and tailored to your needs. Don’t leave it to...

Budget 30th October 2024

Labour is holding its first budget on 30th October and speculation has been rife about its potential impacts, especially on small businesses. All existing clients will receive a summarised easy to understand budget report on the 31st October, highlighting any issues...

Basis Period Reform

If you are a sole trader, or operating in a partnership, then the basis period reform which commences in 2023/24 could affect you. If your accounting period does not align with the tax year, then you must extend your accounting period to 5th April (or 31st March)....

Beware of Fraudsters

The latest HMRC scams seem to be reverting back to postal letters – just as everyone is now more alert to potentially fraudulent emails and text messages purported to be from HMRC. If you receive any communication from HMRC asking for payments (especially with some...

Happy New Tax Year

As we embark on the 2024/25 tax year, just now is as good a time as any to have a ‘spring clean’ of your business accounts, or your personal tax situation. Although January 2025, being the deadline for submitting your self-assessment tax return and paying any tax due,...

Navigating the Financial Maze: Unraveling the Secrets of Business Bookkeeping

In the dynamic world of business, maintaining a firm grip on your financials is crucial for success. No matter the size or industry of your company, managing your financial transactions is a task that can't be ignored. That's where Smith Accountancy steps in to help...